Read Me: This is written from the perspective of an enthusiast and lay-person. This is all evidence collected from primary sources. Please consult a healthcare administrator, licensed health insurance agent, your primary care provider, or your local community clinic for resources specific to your situation. I am simply a technology venture capitalist, investor in health technology, board director of a clinical practice and telemedicine platform, and concerned citizen.

6.6 million people applied for unemployment insurance (UI) last week. That number is 2x higher than the previous record for unemployment claims in a week–– the 3 million the week before. The COVID-19 crisis is, indeed, of a magnitude and intensity we haven’t seen in this country in a generation. It’s important to note: applied for UI does not mean “were unemployed”. There are plenty of gig workers –– Uber drivers, freelancers, contractors –– people who don’t know about unemployment insurance, people who got discouraged by what we are hearing are very long wait times on the phone and crashing websites, or simply weren’t eligible.

In my humble opinion, the most important implication of this newfound employment shock is: in a country where so much health insurance is tied to employers: where will 10 (to 40) million people get healthcare? If this job loss weren’t because of a pandemic, I reckon this would be the #1 priority. Now, it is the #0 priority. So what to do (right now) if you are one of these people?

What to do if I lose my job and need health insurance?

You have three options:

- Medicaid Established in 1965 under President L.B. Johnson, this is government sponsored healthcare, focused on supporting Americans who make less (depends on the state, but typically <$17,000 per individual, or $32,000 per household). This is very comprehensive coverage, and will give you access to dental, vision, and speciality services. If you are eligible for this, it is by far the best option if you are jobless.

- **COBRA** (Continuation of health coverage) Established in 1986 under President Reagan, this program mandates that insurers provide 18 months of continuing coverage for customers who have been covered by an employer-sponsored plan. So, if you get insurance from work, you can continue to. The rub here, is you have to pay the entire premium. e.g. If you were paying $200/month and your employer was paying $1000/month, you’ll now be paying $1200/month.

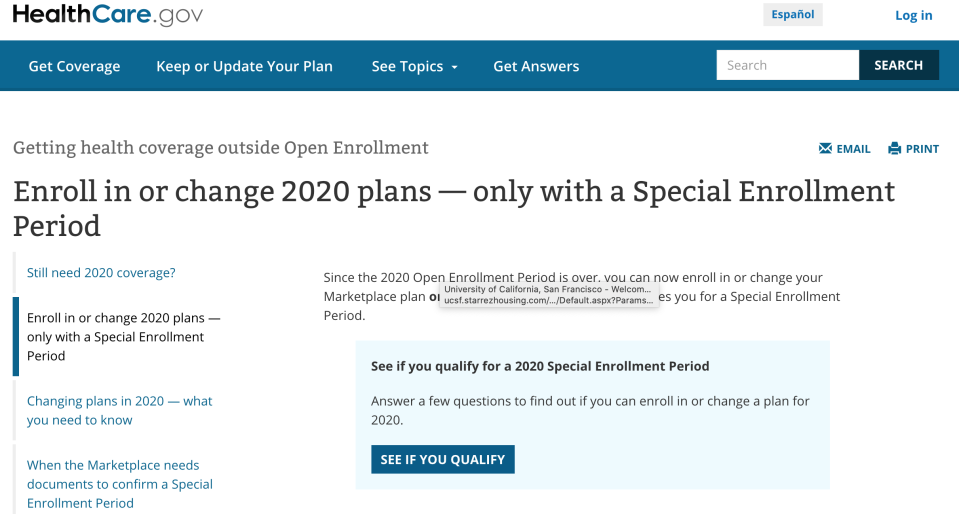

- ACA insurance marketplace Established in 2010 under President Obama, this program creates an exchange for individuals to purchase health insurance directly online. Typically, you can buy your ACA insurance policy during Open Enrollment, which runs from October through January. If you have lost coverage due to losing your job, however, there is a Special Enrollment available year-round which allows you to sign up for a new policy.

With ACA insurance, you can get tax credits and subsidized coverage depending on your financial situation. Unfortunately, the healthcare.gov website is famously not the most user-friendly interface out there. (See below.) But there are good resources for making this process more legible.

Resources on finding an ACA policy: healthcare.gov, stridehealth.com, getinsured.com. Ther are state specific resources, but if you want national access via CMS (Centers for Medicare & Medicaid Services), the resources listed here are your best bet. If you had employer-sponsored insurance that you just lost because you were laid off, resigned, or had your hours cut below the threshold to retain benefits, you are almost certainly eligible, so you must apply. Other qualifying events that are explicitly protected for special enrollment: moved to a new county or zip code, changed your household income, got married, lost dependent status (e.g. turned 27), had a baby, changed immigration status,

What to do if you don’t have insurance right now?

- Urgent care is better than the emergency room. Very important to note! First, it is cheaper. The average urgent care visit costs approximately $150 (and typically range from $50 to $250), while you will pay $200 to $800 for the same procedures at an emergency room. Most urgent care facilities across the country accept direct pay, you can make an appointment (which you can’t at an emergency room). Second, we need to keep emergency rooms available for emergencies. This is always true, but particularly in moments like this one, that becomes a matter of an entire system being able to adequately serve the surges in demand or not. I like SolvHealth.com for urgent care and same-day appointments.

What to do if you are undocumented?

- Community Health Clinics: These clinics are specifically designed for people who have limited resources or are otherwise excluded from the health system. You will pay, but it is $25-75 for typical visit, and I like this resource for discovering the one in your state https://www.freeclinics.com/

- Medical Schools! A lot of medical schools have free clinics where medical students moonlight and MD’s volunteer a few hours a week. This varies wildly by region, so look up the closest medical schools in your region to learn more.

- Emergency Rooms – If you have literally no other option for care (there isn’t a medical school or community health clinic in your region, and you cannot access urgent care), federal law protects anyone walking into an emergency room for a hospital that takes federal funding for care. It is just stabilizing care, and you will be released at the soonest possible moment, but this option is available. Call your hospital emergency room to ask before you go.

Where should I go to fill my prescriptions?

If you have insurance still, then make sure your pharmacy details are up to date with your provider. Pharmacies should say open during this period, as they did in Italy through the lockdown.

If you don’t, here are a few options to consider below:

- For all they are maligned, some drugmakers have programs called “pharmaceutical assistant programs” where, if you are uninsured or make below a certain income (see here to find out what you might qualify for: https://www.medicare.gov/pharmaceutical-assistance-program/) where they offer drugs at lower cost –– and in some cases free.

- You can actually buy them off the web — companies like GoodRx allow you to buy discounted and/or more affordable prescription medicines directly. Others, like forhims.com and forhers.com have a cashpay option, as well.

- Buy generics! There are prescription discount cards, which allow you to buy from pharmacy networks that focus on generics, and can be discounted, sometimes as much as 80%, off the MSRP you would find elsewhere. (NB: https://www.consumerreports.org/cro/2012/12/a-drugstore-tool-we-re-not-crazy-about/index.htm)