Bubbles always pop. Balloons sometimes do: but they often kind of… sigh. Technically, that’s the difference: a bubble exists until it doesn’t, while a balloon can spend a long time in the in‑between—less pressure than before, but still very much there. In markets, a bubble is the thing you tell your grandkids about. A balloon is the thing you might forget happened until you pull up a chart.

2021 to 2022, I think, was a balloon. The major indices sold off hard—roughly a quarter off the S&P 500 from peak to trough, and about a third off the high‑growth, tech‑heavy stuff. That’s real pain. But it is not 2000‑style or 2008‑style pain, where you lose half or more of the value and wait years just to get back to even. Earnings never completely rolled over; forward profit estimates for large public companies bent, but they did not break. Capital didn’t evaporate; it took a breath. And in our world, there was a slowdown, there were layoffs, there was a reset, but it was honestly modest.

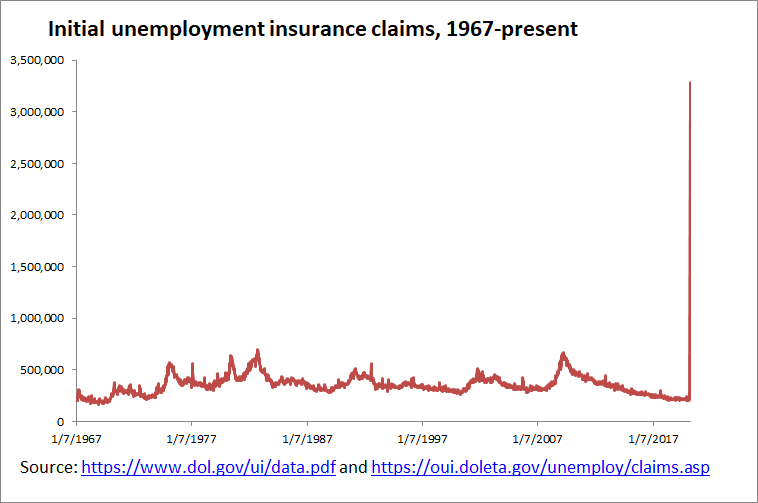

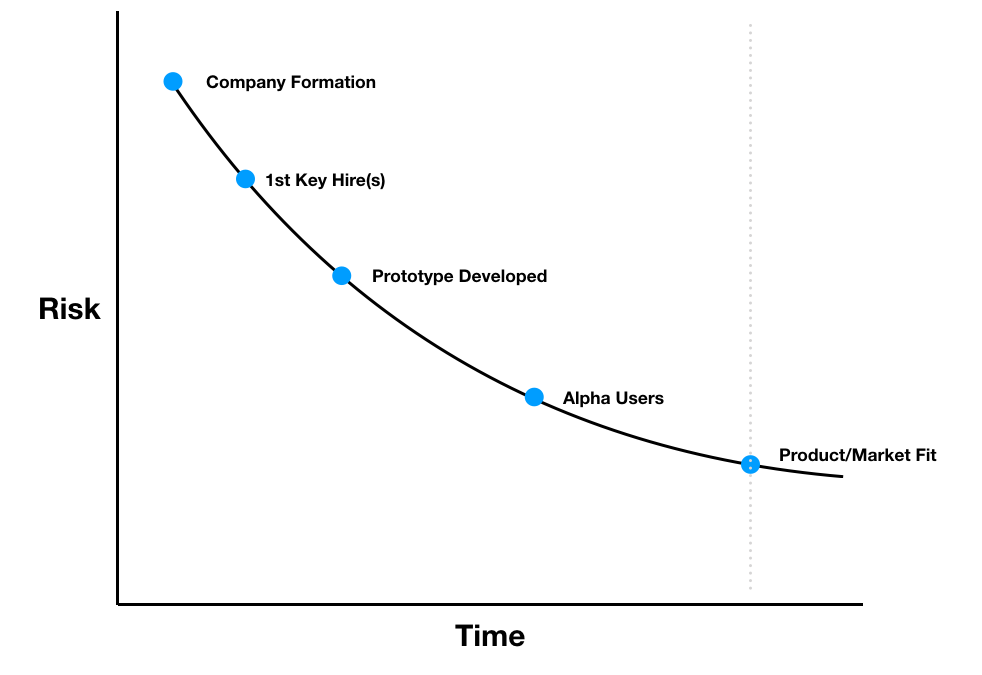

The more interesting story is what came next. Venture went from “everything gets funded” in 2021, to “only the obvious and the over‑signaled get funded” in 2022–2023. $650B was invested in 2021, $450B in 2022, and $250B in 2023… Global startup dollars fell sharply from the 2021 peak, but they didn’t revert to some pre‑internet baseline; they just reverted to pre-2021 levels. The balloon shrank, but it didn’t go back in the box.

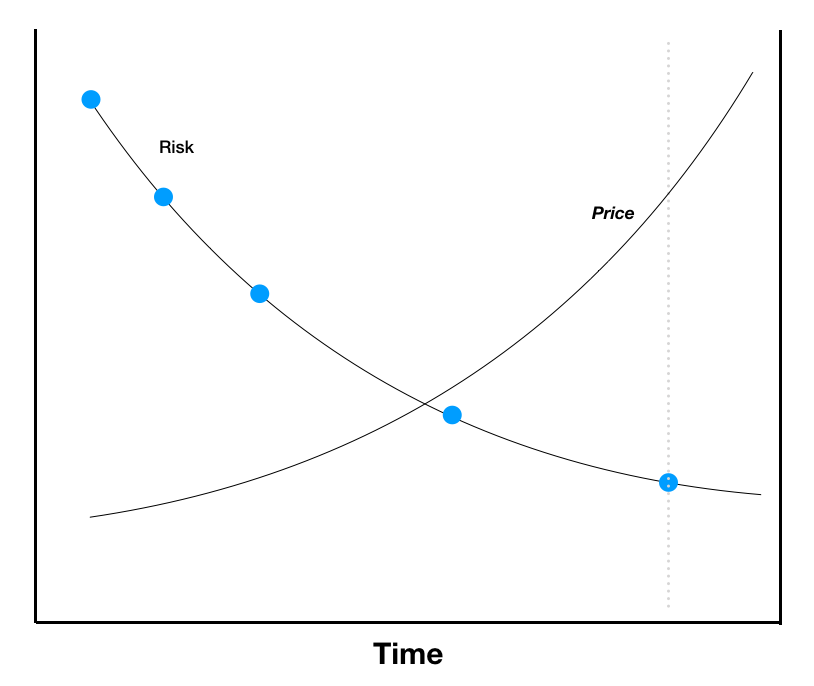

And then AI showed up with a needle to refill the balloon. By 2024, total startup funding had stabilized and nudged up, but the composition had radically shifted: AI was suddenly the main event, pulling in over 100 billion dollars in a year and accounting for a huge share of global venture volume. “Venture capital” became, in many rooms, shorthand for “AI capital.” From the outside, that sequence can look like resilience. “See? The system works. We took a hit, we reallocated, we found the next growth engine.” That’s one reading. Another reading: this is what markets look like when they forget how to sit still.

In the meme era, investors have been trained—algorithmically, socially, and emotionally—to always be “on trend.” There is always a new ticker, a new sector, a new acronym, a new story. As soon as the air in the balloon starts to let, attention rushes to fill it with the next story. The constraint is no longer, “Is this asset actually mispriced on fundamentals?” but, “Is there a large enough crowd willing to believe this story at the same time?”

2021 answered that with “yes, for almost anything.” 2022 answered with “okay, maybe not anything.” 2023–2025 answered with “fine, but definitely for AI.” So when people talk about the “asset bubble of 2021” and the “pullback of 2022,” it is tempting to call it a bubble bursting. But structurally, I actually think it looked much more like a balloon: pressure out, but not gone; capital cautious, but not traumatized; and then, almost immediately, re‑pressurized around a new obsession. The era of meme investing doesn’t give you many clean endings. It gives you rotations.

Bubbles are about finality. Balloons are about transfer. In this cycle, the excess didn’t disappear. It just moved—from “everything growth” to “everything AI.” A close investor friend of mine said: “it feels like it’s 1999. But it’s, like, 1999 forever”. I keep thinking about that.