Was chatting with a friend about the dynamics of those questions, and wrote it out for myself, so figured I’d share those thoughts here.

Now you know.

tedr:

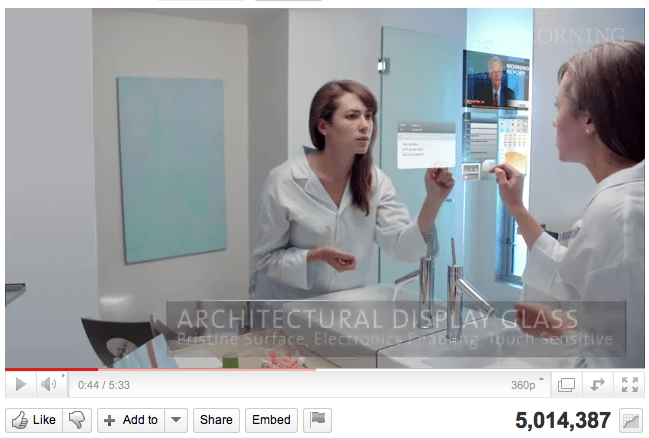

Mark my words, the bathroom mirror will be the daily Quantified Self interface.

(But I’m sure I’ll stand there cold in a towel doing tumblr reblogs too 😉

Screen shot from a Corning video that shows many realistic and unrealistic interfaces of the near-ish future.

Stop Building Apps and Start Disrupting Industries

You either build something that makes the world a better place or you don’t. There are complete industries built on creating arbitrary value for the world (investment banking). And there are complete industries built around innovation and creating value for the world (technology).

If you’re an entrepreneur where your success is built around the value you create for the world (e.g. Apple) , you have an opportunity to disrupt entire industries. The world doesn’t need another “Groupon for X”; we need more companies disrupting archaic institutions like healthcare, education, insurance, government, and banking. We need more companies like Uber that receive cease & desist letters from their city to shut down. And more companies like ProFounder, Votizen, BankSimple, Art.sy andMassive Health that utilize the power of the web to democratize entire industries.

So, the next time you think about starting or joining a company, think about your individual impact on the world. You have a real opportunity to make it better.

Wisdom from the dude Mike Karnjanaprakorn.

Builders and Sellers

I’ve been thinking a lot lately about the various job functions that go into technology startups. I have many friends who are product managers, “biz dev guys”, “programmers or software engineers”, developers or designers, marketers, community managers, “VPs of operations and COOs”, etc. Lately, I’ve seen a fair number of “chief creative officers” and “chief experience officers.” This is all, mind you, in companies with fewer than 10 people. It is dizzying, and honestly, I have beef. As I see it, high-technology companies, whether a social network, hardware device, widget, or mobile app, are fundamentally similar in the early stages. They require two functions: builders and sellers.

I worry that startups, in the spirit of attracting talent, go out of their way to create esoteric titles, each of whose utility ends up getting lost in translation. Enough “Strategy.” Every employee should be strategic. Enough “Experience.” Hire well, codify your values, and the experience will follow. “Creativity” is a personality trait, not a job function. Simplifying roles to ‘builders’ and ‘sellers’ adds clarity, and enables people to focus on the value they provide to a young business.

The ‘builder’ side of the equation is easier to define. Builders tend to be technical, naturally, but not always. They create the product that will be sold: software architect, UI/UX designer, front-end developer, and sometimes community managers or writers for content-driven products.

The ‘seller’ side of the equation is more complicated. Sellers can be everything from business development, to sales, to marketing, to community management. For some businesses, product managers are more sellers than builders when their job is to communicate product to stakeholders. Raising venture capital, building out a customer base, finding organizations to partner with, branding, and certain types of social media, all fall under the category of selling.

People take issue with this framework for a number of reasons. First of all, many high-technology companies don’t have cashflow when they start, with finances limited to a venture or seed investment. Therefore, they think there’s nothing to sell yet. I disagree: You don’t have to have a revenue model to distinguish between builders and sellers. Sellers take the product and communicate it outwardly, and even sometimes inwardly. A seller is responsible for the ‘why’, and a builder the ‘what’ which the ‘why’ explains.

Second of all, there is an unfounded bias against “sales” and “salespeople” among the startup community. Why is that? Most the world’s most influential CEOs started as traditional salesman. Sales, broadly construed, is the bread and butter of commerce, and is how a product reaches the person who wants it. To be a seller is not inferior to being a builder. Each function is critically important, and irrelevant without the other.

So, early-stage startup employee, take a moment and ask yourself: Are you a builder or a seller? If you don’t know, you should figure it out, and start doing one or both as soon as possible.

I’ve been getting into photography. This is my first “portrait” with a real camera. Who better a subject than Martha! And on Valentine’s Day, no less. ❤

The Quantified Self

I had an interesting meeting with a company on Friday who is building some consumer health technology looking to strengthen a person’s core with some cool hardware (can’t speak more about it just yet). During this meeting, we were talking about the recent trend of what is often referred to as the “quantified self”. This trend, as marked by the recent ubiquity (among the tech community) of Jawbone’s UP, Nike’s Fuelband, Fitbit, Basis, Runkeeper, Endomondo, DailyMile, etc., shows that personal health data is certainly IN. Moreover, RockHealth and other programs are devoting much needed energy and time into cracking the broader healthcare nut, which is a big hairy mess with many moving (and broken) parts.

With the quantified self, the thesis goes as follows: why is it that someone my age knows everything about his social data, knows everything about a company’s (say, Facebook’s) vitals, but if you ask a twenty-something male what his genetic makeup, blood pressure, cholesterol level, or body fat index is, the chance that he knows more than 2 out of 4 of those is TINY. With the gyroscope, accelerometer, and GPS capabilities of the iPhone and other smartphone technology, all you need is bluetooth and a compass and you’ve got all the hardware necessary to put together a comprehensive data gathering, recording, and delivery tool, so that a person can keep track of (and thus hold himself accountable for and care about) his own health statistics. This is cool.

What I’ve found companies are choosing as a strategy to this end, which makes sense on its face, is to design it as an outward fashion accessory, akin to the Livestrong band, to make it fashionable to be healthy. This method seems to have worked like a charm, and is catching on like wildfire in my immediate sphere of influence, and apparently beyond. The worry, though, which the entrepreneur I spoke to brought up, is that by becoming so trendy so quickly, it is increasingly less about *being* healthy, and more about *signaling* health consciousness. Remember when all those celebrities were wearing those yellow bands during the frenzy of the early 2000s? I worry that the same might happen with these tools. A lot of talk, and even a lot of units sold of these various devices, but no comprehensive improvements in wellness or health. I am inspired by Nick Crocker’s approach to “lifestyle health”, and I can’t help but be wary of the spate of products that are hoping to capitalize on this (critically important and powerful) mode of thinking. That said, if done right, personal health analytics is easily the most powerful application of smartphone technology that I can think of, and something that could save the government billions, if not trillions, of dollars. Not much direction to this post, just musing on the things I’ve seen on the interwebs lately.

22 years ago, this man was brought back home to Soweto.